Prevent FTC fines and cyber threats with Sieben Cybersecurity

Get everything you need to safeguard sensitive information, defend your business against cyber-attacks, and establish a secure environment—all under one roof.

Get Started

What Sieben Cybersecurity Can

Do for You

The IRS and FTC demand secure data for you and your clients, and the FTC isn’t shy about imposing hefty fines for non-compliance. Becoming compliant is tough, and a quick Google search will overwhelm you with information.

Thankfully, we’ve developed a cybersecurity solution to alleviate these burdens before they escalate. We’ve combined deep industry knowledge with top cybersecurity experts to create a reliable, secure, affordable, and easy-to-implement solution for your tax pro business.

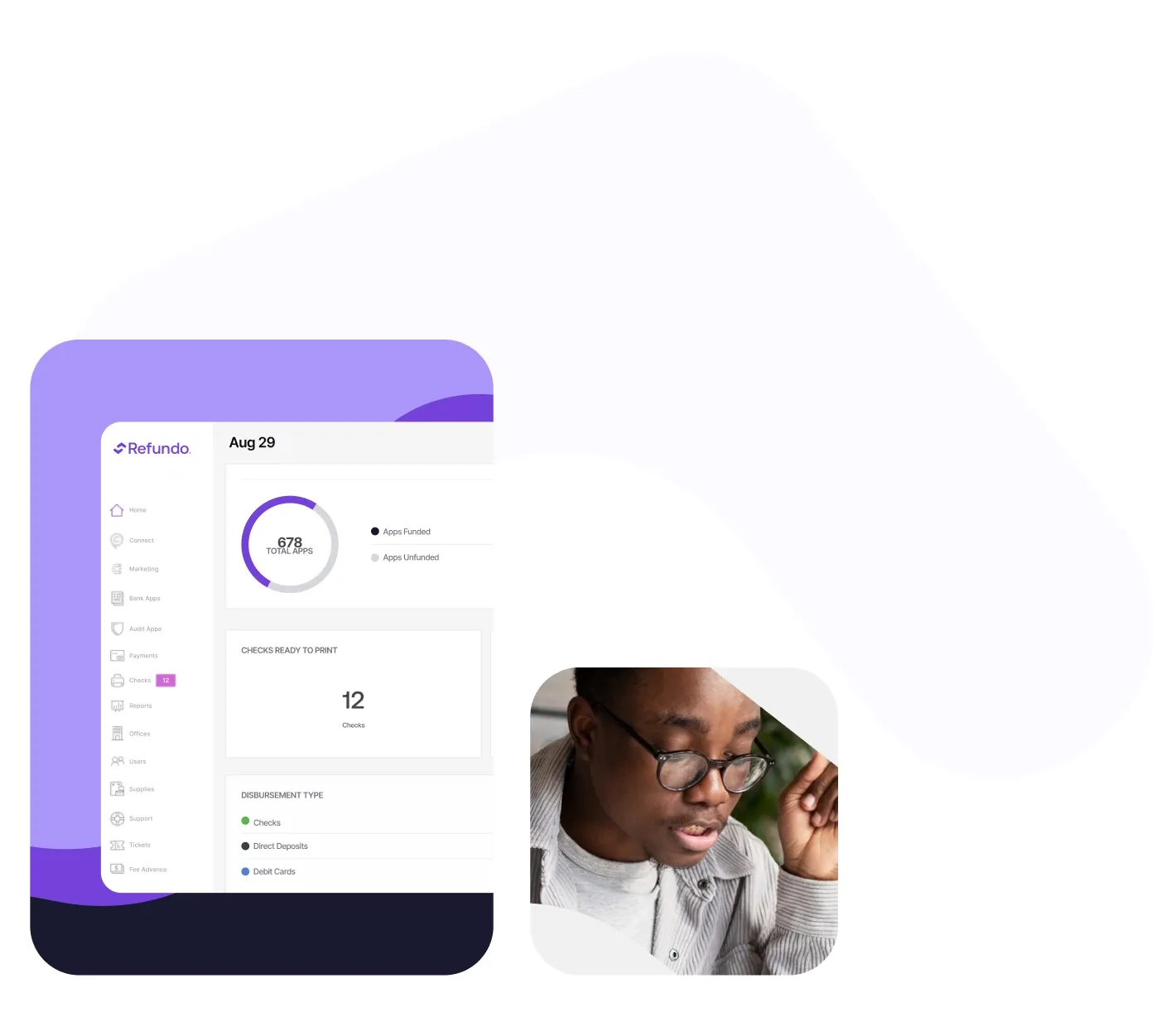

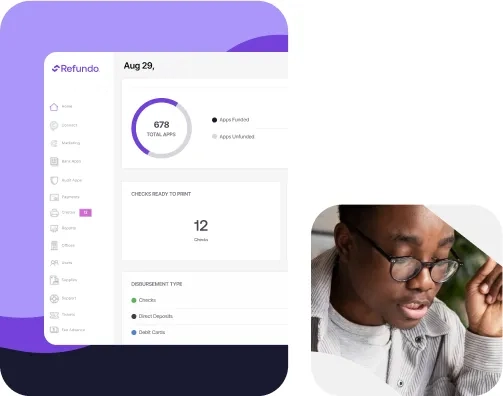

Refundo has been by your side and continues to stay by your side. Our new cybersecurity solution is just one of the many ways we keep you and your business safe.

Having a security plan is an IRS requirement, so why not protect your data and business against threats with your partners at Refundo?

Sign up now to protect your data from cyber threats and ensure peace of mind for your business.

Tax season often brings chaos, compounded by the handling of sensitive client information. We will ensure that you are IRS compliant, safeguarded from emerging cyber schemes, and protected with 24/7 monitoring.

Here’s what you’ll get:

Highly effective solutions

.avif)

.avif)

Get compliant in under 3 days with Sieben Cybersecurity

Sieben was made for tax pros. Our solution ensures compliance in three simple steps. No more fines, just peace of mind for your business.

Simple, transparent pricing

per year

per year

per year

Download Our WISP Checklist

Frequently Asked Questions

The template provided in IRS Publication 5708 offers high-level sample information. To enhance ease of implementation, we have supplemented this with additional templates that are ready for easy editing and updating as well as other helpful information.

Furthermore, we are committed to continuously monitoring FTC and IRS requirements and recommendations. As updates are released, we will promptly update our Written Information Security Plan (WISP) and provide these updates to our customer base.

- Should a threat alert come in, Refundo will immediately contact the designated customer point of contact (POC) and inform them of the potential threat.

- During that time, our cybersecurity partners will continue to investigate to understand the threat.

- The threat will be contained swiftly. If additional steps are needed, our Sieben team will work with you and provide recommendations.

Installation is free! Refundo will collaborate with customers for a smooth installation. Setup is quick and easy — once the installation is complete, customers can get back to their busy day and focus on building their business.

Yes, it certainly does. Here’s the deal: if you’re dealing with fewer than 5,000 consumer records, then some aspects don’t apply. For instance, certain requirements, like having a written risk assessment, an incident response plan, periodic penetration testing and vulnerability assessments, and preparing the annual report to the board of directors, may not be necessary.

However, despite these few compliance exceptions, the priority remains on protecting you from potential breaches. It’s crucial, especially for small businesses, as they are the most vulnerable.

The potential fines imposed by the Federal Trade Commission (FTC) for tax preparers who fail to have a Written Information Security Plan (WISP) can vary based on several factors, including the severity of the violation and the number of affected individuals.

However, the FTC has the authority to levy civil penalties of up to $100,000 per violation, as of 2022. These fines can quickly add up depending on the scale and scope of the breach or non-compliance.

Additionally, tax preparers may face other legal repercussions, such as legal fees and damage to their reputation, resulting from the lack of a WISP and subsequent data breaches.

Cybersecurity involves protecting computer systems, networks, and data from digital attacks. It’s crucial for tax professionals to safeguard sensitive client information, such as social security numbers and financial data, from cyber threats like hacking and data breaches.

While implementing network monitoring and threat detection services may introduce some initial adjustments, their benefits outweigh any potential disruptions. These services are designed to enhance security by identifying and mitigating potential threats to your network and data.

By investing in these services, you can better protect your business from cyber threats and safeguard sensitive data, ultimately contributing to the long-term success and resilience of your tax practice.

1. Servers:

All servers with Microsoft Windows Operating Systems must be running a Microsoft-supported operating system and have all current Microsoft Service Packs and Critical Updates installed.

2. End-User Operating Systems:

• All desktop PCs and notebooks/laptops with Microsoft Windows must be running a Microsoft-supported OS with all current Service Packs and Critical Updates installed.

• All Apple Mac desktop and laptop devices running macOS must be running an Apple-supported OS with all current Apple updates installed.

• Operational requirements for Linux or proprietary operating systems will be reviewed and approved on a case-by-case basis.

.webp)

.svg)